open end loan examples

With some forms of open-end credit theres no end date. Triggered Terms 102616 b.

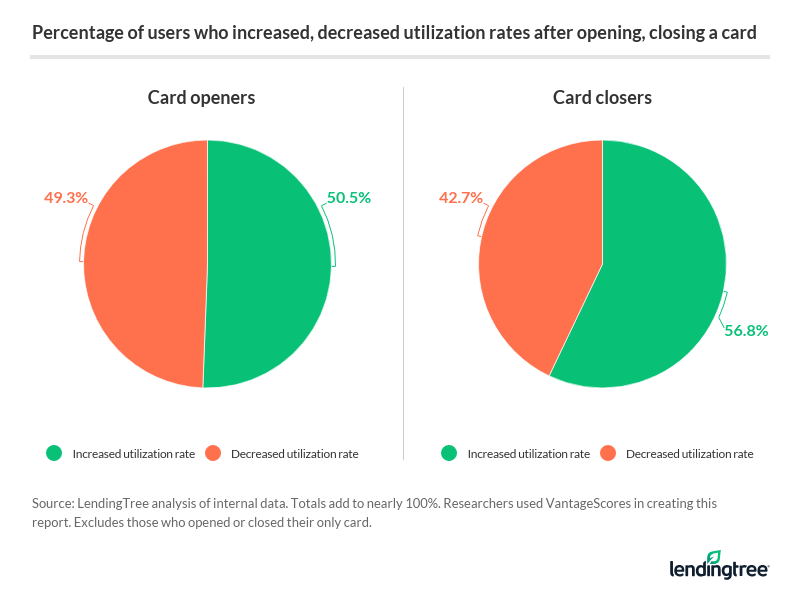

Credit Score Movements When Opening Closing A Card Lendingtree

Open-end credit must be repaid over time and generally gives consumers the option of making minimum monthly payments or greater each billing cycle.

. Personal lines of credit and credit cards. The loan has a term of 30 years with a fixed interest rate of 475. Open-End Mortgage Example.

Open-end loan agreements are also known as revolving credit accounts. Other examples of open ended loans are. Which is an open end loan.

Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. Credit cards are the most common example of an open end loan in the consumer market because they provide flexible access to funds that are immediately available once a payment is received. Lets give an example of an open-end loan.

Streamlined Document Workflows for Any Industry. Lines of credit and credit cards are examples of open-ended loans. If the plan provides for a variable rate that fact must be disclosed.

Any Borrower may sign a Loan Draft payable to any person or entity that accepts. Depending on the product you use you might be able to access the funds via check card or electronic transfer. For example if an open-end credit account ceases to be exempt A closed-end loan is exempt under 10263b unless the extension of credit is secured 22.

Examples of open-ended loans include lines of credit and credit cards. An open-ended loan is a loan that does not have a definite end date. Get Offers From Top 7 Online Lenders.

You use 8000 of it repay 5000 of it in the next couple of months 21. Home equity lines of credit HELOC and credit cards on the other hand are examples of open-end loans. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property.

An open-ended loan is a loan that does not have a definite end date. An agreement between financial institution and borrower whereby the borrower is preapproved to take out funds up to a certain dollar limit. Example of an Open-End Mortgage.

The main distinction between these two types of credit is in the amount of debt and how it is repaid. Department store credit cards Service station credit cards Personal line of credit Business line of credit Bank-issued credit card Overdraft protection. Ad Create a Custom Loan Document to Ensure Payment Within a Specified Time Period.

Examples of open-ended loans include lines of credit and credit cards. Theres no end date for this type of loan. Open-End Loan Real Estate Agent Directory.

Membership or Participation Fees. Examples of open-ended loans include lines of credit and credit cards. An agreement between a financial institution and borrower whereby the borrower is similarly allowed to borrow funds up to a preapproved dollar limit.

Credit cards personal lines of credit and home equity lines of credit are examples of open-end credit. Open-end loans offer you the chance to borrow as much or as little money as you want up to a certain amount and then pay back some or all of the funds monthly. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the abbreviation APR.

Common examples of open-end credit are credit cards and lines of credit. Find Forms for Your Industry in Minutes. The borrower receives rights to the 400000 principal amount but does not have to take the full amount at once.

For example assume a borrower obtains a 200000 open-end mortgage to purchase a home. Some open-end credit accounts have interest start accruing immediately once the borrower makes a draw on their credit limit. As you repay what youve borrowed you can draw from the credit line again and again.

Examples of open-ended loans include lines of credit and credit cards. An open-ended loan is one that does not have a set expiration date. The conditions of open-ended loans may be determined by a persons credit score.

Definition and Examples of an Open-End Mortgage. What Is The Difference Between Open Ended And Closed Ended Loans. Open-end credit is a contrast to closed-end credit which is more commonly called an installment loan.

An open-ended loan is a loan that does not have a definite end date. Ad State-specific Legal Forms Form Packages for Investing Services. Once the funds have been transferred to the borrower they must be paid back entirely to satisfy the terms of the borrowing agreement and conclude.

Another popular loan type in the consumer market is a home equity line of credit which allows borrowers to access funds based on the amount of equity in their homes. The loan has a term of 30 years with a fixed interest rate of 575. Follow Simple Instructions to Create a Legally Binding Loan Agreement in 5-10 Minutes.

Borrowers with an open-end credit account can make repeated transactions up to the credit limit. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. For example assume a borrower obtains a 400000 open-end mortgage to purchase a home.

Itll always be open for you. You take 10000 on an open-end loan. Ad Need a Business Loan.

An agreement between a financial institution and borrower whereby the borrower is similarly allowed to borrow funds up to a preapproved dollar limit. Some dont accrue interest unless a principal balance is still on the loan after a billing period. Lets give an example of an open-end loan.

Some examples of open-end credit loans are credit cards home equity lines of credit HELOC and a personal line of credit. The terms of open-ended loans may be based on an individuals credit score. Unlike a credit card which is an excellent example of an open-end loan closed-end loans do not allow borrowers to continually access new funds when they have paid back a portion of the original borrowed amount.

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Loan Vs Mortgage Difference And Comparison Diffen

What Is Open End Credit Experian

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

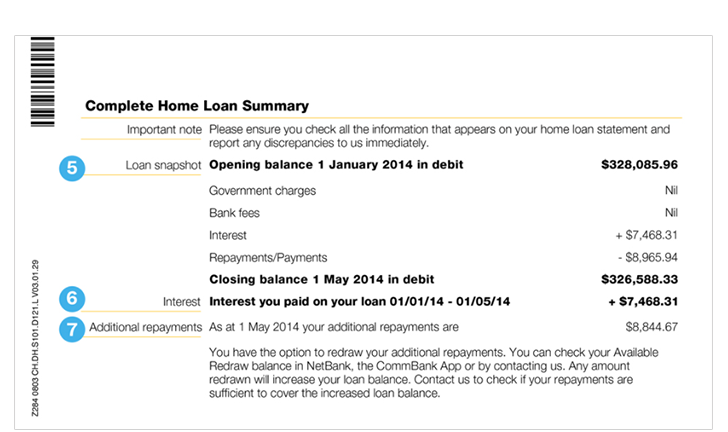

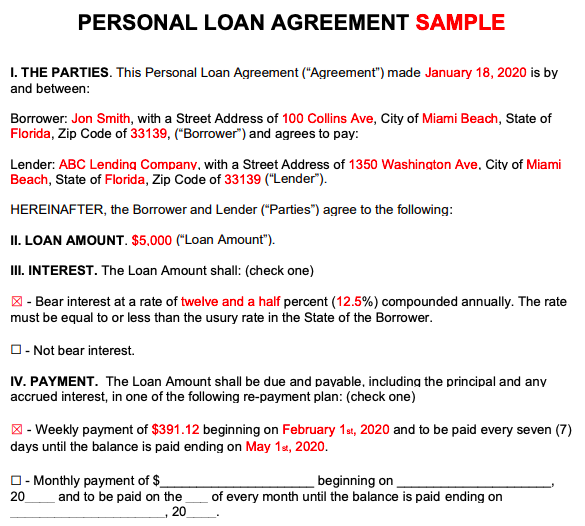

Personal Loan Agreements How To Create This Borrowing Contract

Start Up Loans Small Businesses Can Borrow Up To 25 000

Truth In Lending Act Tila Consumer Rights Protections

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

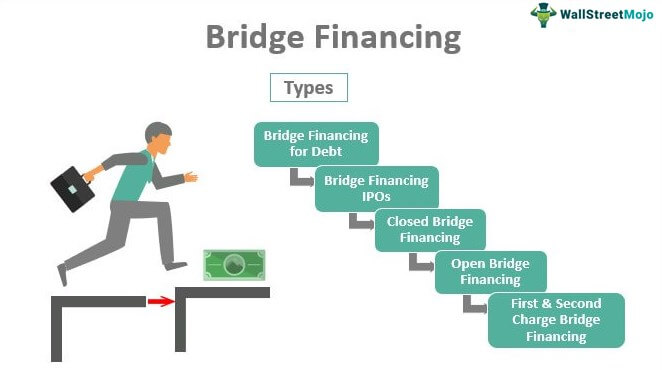

Bridge Financing Meaning Examples How Does It Work

Consumer Loan Types And Categories Of Consumer Loan With Example

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Creditor Coordination In Resolving Non Performing Corporate Loans

Stock Statement For Bank Loan And Sample Format Download Lopol Org

:max_bytes(150000):strip_icc():gifv()/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)